update on unemployment tax refund today

The IRS plans to send another tranche by the end of the year. With The Latest Batch Uncle Sam Has Now Sent Tax Refunds To Over 11 Million Americans For The 10200 Unemployment Compensation Tax Exemption.

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

You have an adjustment because of the exclusion that will result in an increase in any non-refundable or refundable credits reported on the original return.

. It excludes up to 10200 of unemployment compensation payments from gross income if the taxpayers modified adjusted gross income is less than 150000. Overall the IRS says unprocessed individual tax year 2020 returns included those with errors. Some will receive refunds while others will have the overpayment applied to taxes due or other debts.

Reached for comment an IRS spokesperson had no immediate on. Overall the IRS says unprocessed individual tax year 2020 returns included those with errors. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000.

This Wednesday August 11 will mark two weeks since the last round. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. If there are any errors or if you filed a claim for an earned income tax credit or the child tax credit the wait could be lengthyIf there is an issue holding up your return the resolution depends on how quickly and accurately you respond and.

In the latest batch of refunds announced in November however the average was 1189. The IRS says 62million tax returns from 2020 remain unprocessed. The IRS usually issues tax refunds within three weeks but some taxpayers have been waiting months to receive their payments.

Thousands of taxpayers may still be waiting for a. The agency had sent more than 117 million refunds worth 144 billion as of Nov. You already filed a tax return and did not claim the unemployment exclusion.

Guto Harri reportedly lobbied No 10 chief of staff to stop ban on Huawei. Now the good news is that last year the IRS paid tax filers interest on refunds issued after the original April 15 tax-filing deadline. However the IRS has not yet announced a date for August payments.

The American Rescue Plan Act of 2021 offered relief to people who received unemployment compensation in 2020 at the height of the pandemic when companies were laying off millions of workers. By Anuradha Garg. The agency had sent more than 117 million refunds worth 144 billion as of Nov.

Irs unemployment tax refund august update. Discover short videos related to unemployment tax refund update today on TikTok. The IRS is now concentrating on more complex returns continuing this process into 2022.

T he Internal Revenue Service IRS has started issuing tax refunds to those who received unemployment benefits in 2020 with around 15 million refunds sent out adding to almost nine million. In a blog post on Wednesday Erin M. The IRS will determine the correct taxable amount of unemployment compensation and tax.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000. In the latest batch of refunds announced in november however the average was 1189. Thousands of taxpayers may still be waiting for a.

The IRS efforts to correct unemployment compensation overpayments will help most of the affected taxpayers avoid filing an amended tax return. Another way is to check your tax transcript if you have an online account with the IRS. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. Some 2020 unemployment tax refunds delayed until 2022 irs. This is available under View Tax Records then click the Get Transcript button and choose the federal tax option.

The refunds which were first announced in March are the result of changes authorized by the American Rescue Plan Act which excluded up to 10200 in taxable income for people who collected. This is your fourth stimulus check update today 2021 and daily news update. Households waiting for unemployment tax refunds will be unhappy to know that 436000 returns are still stuck in the irs system.

IR-2021-159 July 28 2021. The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion. So far the IRS has identified over 16 million taxpayers who may be eligible for the adjustment.

Watch popular content from the following creators. In a blog post on Wednesday Erin M. After this you should select the 2020 Account Transcript and scan the transactions section for any entries as Refund issued.

22 2022 Published 742 am. Thats the same data. This is your fourth stimulus check update today 2021 and daily news update.

The unemployment tax break provided an exclusion of up to. After several waves of unemployment taxes refund todays update will explore the new upcoming wave of tax returns the irs new update message an expected letter and potential groups expected to receive their 10200 unemployment tax break taxes return for. Collins the national taxpayer advocate provided an update on the 2021 tax filing season with some newly reported details about the refunds which are being.

The News Girl lisaremillard AJ training and consultingnicholefeather1 Tax Professional EA dukelovestaxes The News Girl lisaremillard taxladytishtaxladytish Mr Nelzoncredittaxstrategisnelz Virtual Tax. To date the IRS has issued over 117 million refunds totaling 144billion. People who received unemployment benefits last year and filed tax.

Households waiting for unemployment tax refunds will be unhappy to know that 436000 returns are still stuck in the irs system. A quick update on irs unemployment tax refunds today.

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Irs Starts Sending Tax Refunds To Those Who Overpaid On Unemployment Benefits Cbs News

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

Irsnews On Twitter Irs Is Issuing Refunds For Taxes On 2020 Unemployment Compensation That Were Paid Before They Were Excluded From Taxable Income By Recent Law Changes Details At Https T Co Hcqbfq5oze Https T Co Tt4lhu7uff

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 Chicago

When Will Irs Send Unemployment Tax Refunds 11alive Com

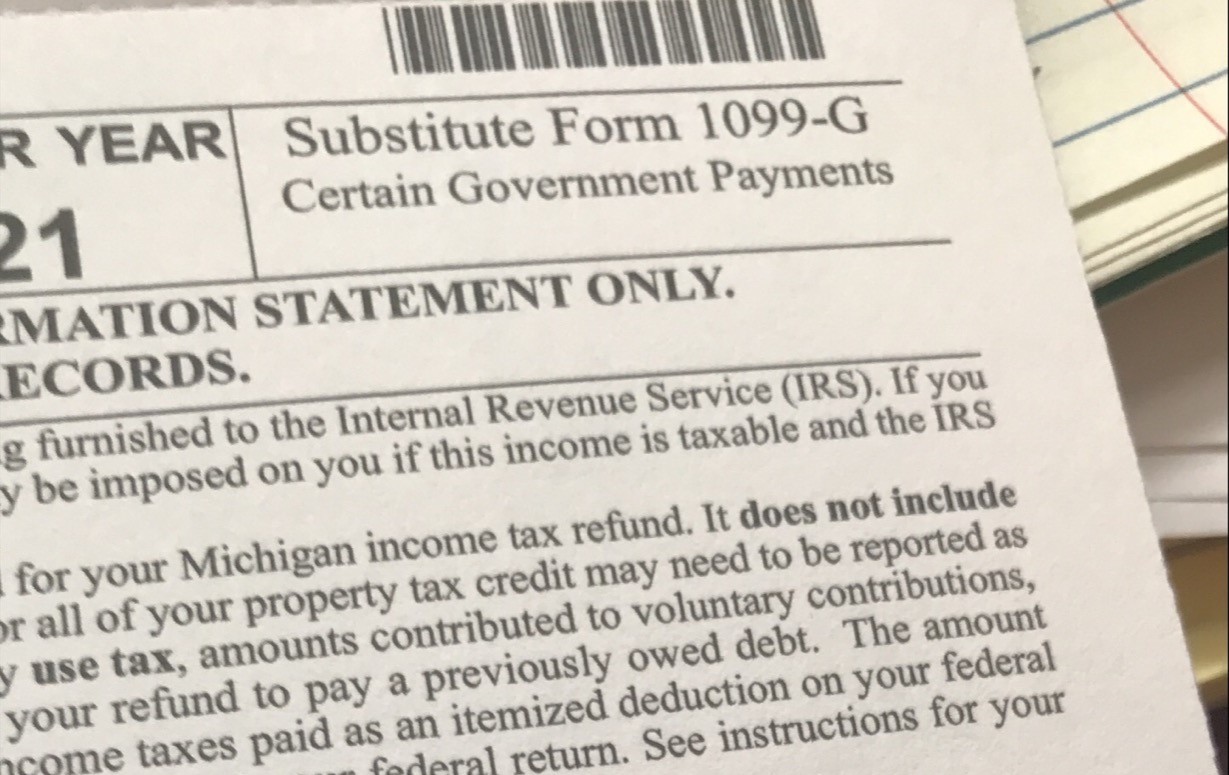

Michigan S Delayed 1099 G Unemployment Tax Forms Now Available Online Mlive Com

Unemployment Tax Refund Update What Is Irs Treas 310 King5 Com

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Confused About Unemployment Tax Refund Question In Comments R Irs

How To Get A Refund For Taxes On Unemployment Benefits Solid State

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor